By Ulf Narloch, CO2 IQ

Getting the incentives right

The business case for green steel is difficult. Even without financing risks and infrastructure gaps, BF-BOF steel remains more cost-competitive. The cost gap depends on production route and geography — with energy prices as main OPEX driver of H2-based DRI and scrap-based EAF. Without market premiums for low-carbon steel, the economics do not add up.

This is where carbon pricing enters the equation. It can narrow the cost gap. The EU is using it as a primary policy tool achieve its Green Deal ambition of cutting emissions by 55% in 2030 compared to 1990 and to become the first carbon-neutral continent by 2050.

The idea of carbon pricing is simple: Add a carbon-based price to internalize the hidden costs of emissions from future damages caused by climate change. How much this price tag would be, is a matter for debate. Economists have argued it to be somewhere between EUR 100 and 300 per ton of CO2.

While a fixed carbon tax would offer the most reliable price signal, policy makers have opted for an

alternative instrument: Emission trading systems (ETS). Here the market is let to find the price — with

supply fixed by an emissions cap.

These so called regulated or compliance carbon markets are becoming increasingly relevant

for steel-making all over the world. They are reshaping cost dynamics in the industry.

Tightening carbon prices in the EU

Carbon prices are not new in steel-making. Since 2005, EU mills fall under the ETS and need an emissions allowance for each tonne of CO2 they emit. Not to give them a disadvantage in global

markets, most of these allowances are handed out for free. Only if emissions are above production-specific benchmarks, additional allowances need to be purchased.

To strengthen the incentives for the ambitious emission cuts needed, the EU decided to phaseout

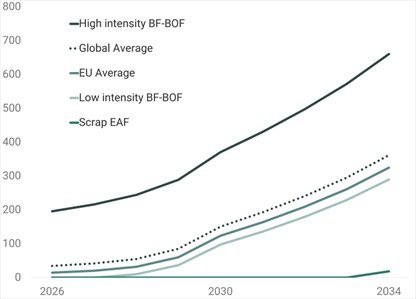

free emission allowances — from 2026 to 2034 when all emissions are fully priced. At today’s ETS-prices of EUR 74 per ton of CO2, carbon costs of EUR 67 in 2030 and EUR 131 per tonne of BF-BOF steel are added to the bill of an average EU steel mill.

As these increased costs bring the risk of carbon leakage from production relocations to places

without carbon pricing, the EU is introducing the Carbon Border Adjustment Mechanism (CBAM).

The world’s first carbon price on imports will level the playing field for overseas steel on EU markets. It will be charged the same carbon price as homemade steel.

Whereas the treatment of EU exports is still unresolved, CBAM certificates need to be purchased for the emissions embedded in imported steel — starting 2026. The share of emissions to be covered by CBAM certificates is rising each year — equivalent to the phase-out of free allowances in the ETS. In 2034, CBAM certificates are fully phased in.

Over the years, the costs of steel on EU markets will go up. By how much, depends on the difference between the good’s carbon-intensity and production-specific benchmarks set by the EU. Taking national-level averages, the CO2 IQ Carbon Cost Simulator reveals some stark differences. Low-carbon steel will gain a cost advantage — greener locations too (Fig 1a).

strategies to purchase CBAM certificates and to hedge price fluctuations.

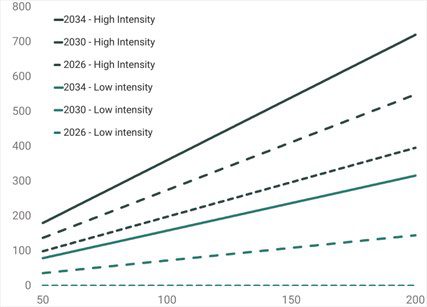

Over time, with supply of emission allowances being tightened, these prices are projected to rise. Pathways vary by projection model and the assumptions made — and will largely depend on the future design of the EU-ETS. Given high uncertainty, the range of possible carbon prices would result in large variations in the added carbon costs (Fig 1b).

Rising global momentum

Carbon pricing is not only building up in the EU. There is action all over the world. The CO2 IQ Carbon Pricing Radar counts 16 non-EU countries with implemented or scheduled carbon prices in the steel industry — some at subnational level. Altogether, these countries make up over 50% of EU imports of CBAM goods in the iron & steel sector.

Most of these countries charge carbon prices on raw materials like sintered ore, pig iron or crude steel. Countries such as Australia and Canada also price emissions from the manufacturing of some iron or steel products. The majority of emission allowances are handed out for free — as in the EU, but they face much lower prices — at least for now.

Carbon prices are expected to gain further momentum. With national budgets being tight and increasing need to define emission targets and mitigation measures, more and more countries are looking into carbon pricing. CBAM is accelerating this trend, as carbon prices paid in the country of origin can be deducted from the CBAM charges to be paid in the EU.

Instead of having carbon revenues be rendered at EU borders, non-EU countries have an incentive to capture them at home. Brazil, India, and Türkiye are already in preparation to implement carbon pricing schemes in alignment with EU’s CBAM. China is extending its national ETS for the power sector to aluminium, cement and iron & steel.

Carbon pricing is not enough

Where does it all leave us for the transition to green steel? It will depend on carbon pricing levels. Globally, they remain low — in most industrial schemes far below 50 EUR per tonne of CO2. The EU is leading the way with the tightest pricing for now. By how much they will rise will also depend on the political will to follow through when social backlash grows.

And even with carbon prices to rise to levels of 200 EUR, in most contexts that will not fully compensate the current economic disadvantage of green steel technologies (see Fig 1b). To close cost gaps, further subsidies may be needed. Germany is experimenting with carbon-contracts-for-difference as an innovative instrument for industrial policy.

The hope is also on market premiums for green steel. With companies in need to meet their self-set climate targets, rising demand can push-up the price for low-carbon alternatives. It remains to be seen if this hope can materialize. Meanwhile, the EU is working towards green lead markets — with public procurement and further incentives to kick-off demand.

All in all, carbon pricing will not be enough. Public support for innovation and infrastructure — e.g. for hydrogen networks or green electricity grids — is needed to enable scale-up and cost reductions. Moreover, regulatory clarity and long-term carbon pricing signals are essential for investments in assets that will operate for decades.

[1] Source: CO2 IQ Carbon Cost Simulator based on ETS and CBAM regulation with national average intensities for direct emissions; for 1a based on yearly averages of projected EU-ETS prices from 6 models