By Jakob Way, Nordic Bio-Graphite AB

The growing graphite shortage

Graphite is a unique form of carbon with excellent electrical and thermal conductivity, making it vital for high-temperature industrial processes like steelmaking. As the steel industry moves away from traditional blast furnaces, EAF steelmaking is gaining traction as a cleaner, more sustainable alternative. Central to this transition are graphite electrodes, which conduct high-current electricity to achieve temperatures exceeding 3,000°C — essential for melting and refining steel. Each tonne of EAF-produced steel consumes approximately 2 to 4 kg of graphite electrodes, emphasizing graphite’s strategic importance. But as EAF steelmaking expands globally, graphite demand is rising, further straining an already tight supply.

Steelmaking isn’t the only industry driving this demand. Graphite is critical for lithium-ion batteries, with each electric vehicle battery containing around 70 kg of graphite on average. It’s also vital in nuclear reactors, fuel cells, and the defence industry. As these sectors grow, competition for graphite intensifies, creating additional pressure on supply chains. Europe produces little graphite domestically, relying mostly on imports. Around 80% of the world’s graphite supply currently originates from China, creating substantial geopolitical risks. By 2030, graphite demand is expected to surpass supply by more than 15%, posing a serious bottleneck for dependent industries like steelmaking.

The hidden fossil footprint of graphite

Graphite comes in two main forms: natural and synthetic. Natural graphite, mined from the earth, causes environmental harm such as deforestation and water pollution, and it also faces supply risks due to geographic concentration. However, natural graphite is unsuitable for EAF electrodes because it lacks sufficient strength, density, and conductivity.

As a result, synthetic graphite, produced from needle coke (a petroleum refining by-product) and coal tar pitch, dominates electrode manufacturing. Converting coke and pitch into graphite requires substantial electricity, which can contribute significantly to its overall emissions, depending on the energy source used. The production process also directly emits CO₂ due to the chemical composition of raw materials. Imported synthetic graphite from China averages around 17 kg of CO₂ emissions per kilogram produced. In coal-reliant regions like Inner Mongolia, this figure can rise to 40 kg per kilogram.

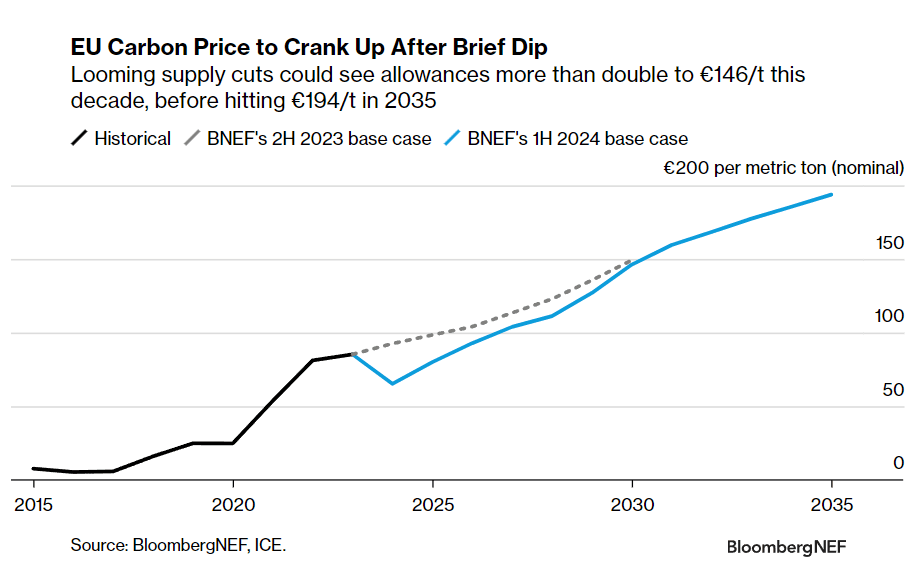

Moreover, graphite electrodes used in steelmaking are mostly carbon. Their combustion releases an additional 3.67 kg of CO₂ per kilogram, significantly contributing to direct (Scope 1) emissions. With the European carbon price (ETS) projected to rise significantly, to €150 per ton of CO₂ from today’s €70, steelmakers face increasing production costs.

For industries pursuing emissions reductions, this is a critical challenge. European steelmakers, automakers, and clean energy companies urgently need a greener, more reliable graphite supply to meet climate targets and reduce reliance on vulnerable global supply chains.

Can recycling fill the gap?

Recycling graphite, particularly from electrode stubs, has potential but faces significant limitations. Currently, only about 3%–10% of graphite from electrodes can realistically be recycled. Recycling involves energy-intensive processes such as purification, cleaning, and re-graphitization at high temperatures (~3,000°C), leading to substantial energy consumption and additional costs.

Contamination from other materials further reduces recycled graphite’s strength and conductivity. Due to these limitations, recycled graphite is primarily reused as a carbon additive (recarburizer) rather than for electrode production.

Despite these challenges, recycling still comes with significant environmental impacts. Studies estimate that the carbon footprint of recycled graphite ranges from 0.5 to 9.8 kg CO₂ per kilogram, which, while lower than imported synthetic graphite, remains substantial.

A new path forward with bio-graphite

Bio-graphite offers a sustainable alternative to fossil-based graphite by utilizing biomass as a renewable carbon source. While bio-based graphite still emits CO₂ when consumed, this carbon originates from renewable biomass rather than fossil fuels. Biomass absorbs CO₂ as it grows, making the entire process carbon-neutral overall. Consequently, bio-graphite is exempt from ETS, both in terms of production emissions and its use in applications such as steelmaking electrodes.

For years, universities, including Sweden’s Royal Institute of Technology (KTH), have explored bio-graphite production. Although research made progress, scalable production methods remained elusive.

At Nordic Bio-Graphite (NBG), we have developed a patent-pending process enabling efficient, industrial-scale bio-graphite production. Our method starts with biochar, a carbon-rich material derived from biomass. Through a specialized refining process, we convert biochar into high-purity graphite suitable for electric arc furnace (EAF) steel electrodes and battery anodes. Unlike synthetic graphite derived from petroleum coke, our bio-graphite is entirely fossil-free, significantly reducing emissions, cutting chemical use by 95%, and lowering energy consumption by 70%.

We are currently scaling up our technology, planning to build a pilot facility and initiate larger-scale testing. We seek partnerships with sustainability-focused companies ready to evaluate bio-graphite as a viable alternative.

For steelmakers and battery manufacturers, bio-graphite presents a clear opportunity: reduced dependency on imports, significantly lower emissions, and a secure, local graphite supply.

Time for Action

Without decisive action, Europe risks falling behind in the global race for green industries. Graphite shortages threaten to increase steelmaking costs and hinder progress toward climate goals. A shortage could also slow the transition to electric vehicles and renewable energy storage, impacting multiple industries.

The good news is that solutions are emerging. Companies like NBG demonstrate that sustainable, fossil-free graphite production is not only feasible but scalable. Accelerating this transition requires investment, supportive policies, and industry collaboration. Governments, manufacturers, and investors must urgently work together to ensure Europe can produce its graphite cleanly, efficiently, and at scale.

The shift from reliance to resilience must begin now. If Europe is to lead the green transition, it must secure the materials that make it possible. Graphite isn’t just another commodity — it’s the backbone of the clean industries of the future.

Facts & figures

- Europe’s graphite demand is expected to increase 20 to 25 times from 2020 to 2040 (IEA).

- By 2030, demand is expected to exceed supply by 2 million metric tonnes, threatening steel and battery industries (Economist).

- China controls more than 80% of global graphite production.

- Synthetic graphite production emits an average of 17 kg CO₂ per kg (Minviro).

- 84 million tonnes of CO₂ emissions per year from European graphite use in EAF electrodes (ECGA).