Climate Bonds Initiative (Climate Bonds) is an international not-for-profit organization working to mobilize global capital for climate action. While public funding is crucial, it is insufficient to meet the challenges of transitioning to net zero. Therefore, Climate Bonds was created with a vision to mobilize institutional investors to counter the short-termism and vested interests that infect politics and finance and undermine action on climate change.

Founded to address the gap in solutions and analysis for private sector contributions to climate goals, Climate Bonds has pioneered the development of green bonds, sustainability-linked bonds, and other labeled debt instruments. They work to establish definitions, standards, and criteria for these instruments to ensure their effectiveness and integrity.

“In my role in the policy team, I concentrate on the vital part that public authorities and policymakers can play in facilitating this transition. Our work spans all sectors of the economy, with my particular focus on energy and industry, specifically addressing challenges in sectors like steel and cement. Through these efforts, we aim to create a robust framework that supports both public and private initiatives in the journey toward a sustainable future,” stated Mr. Passaro.

G20 targets steel and cement

As Mr. Passaro kindly explained, it is common practice for international forums like the G20, the G7, and UN conventions to request input papers to aid discussions. They seek expertise from leaders in specific subjects to provide well-informed perspectives. These short input papers are circulated among delegates and participants in advance to give them a comprehensive understanding of the topics at hand. Each organization then highlights their key discussion points and recommendations to ensure a focused and fruitful discussion.

The request for this report came from the Sustainable Finance Working Group, with whom Climate Bonds have a strong relationship. As Brazil is presiding over the G20 this year, they organized various meetings, including the SFWG. One of their priorities was the transition to a more sustainable economy, with an emphasis on the just element of this transition. They decided to focus on specific sectors such as steel and cement due to their significant impact.

“Steel and cement are the largest industrial emitters, contributing approximately 6-8% each to global CO2 emissions annually. Therefore, addressing emissions in these sectors is crucial. Additionally, there has been notable progress in these industries in recent years, making them ripe for focused discussion,” Mr. Passaro elucidated.

Decade of change

According to the report, emerging markets are and will be crucial for the transition to greener industries, particularly in the aforementioned sectors. These regions hold immense potential for investment and development, moving from non-green to green capacities.

“The general need for focusing on these markets stems from several key reasons. Firstly, the demand for steel and cement is set to increase primarily in emerging markets such as Africa, Latin America, and India. These areas will see the most new capacity being built and sold, driven by economic growth, population increases, rising standards of living, and urbanization. Currently, a significant portion of steel and cement production already takes place in emerging markets. For example, China alone accounts for around 50% of global production, with India also being a major producer. Thus, addressing emissions in these regions is vital. While developed economies like the EU, US, and Japan have advanced regulations and funding for the transition, the bulk of new investments and existing assets are in emerging markets,” Mr. Passaro explained.

“Moreover, the long lifespan of steel and cement assets, often up to 40 years, means that decisions made now will impact emissions well beyond 2050. Building fossil-based infrastructure today would make it difficult, if not impossible, to meet the Paris Agreement targets. This underscores the importance of making ambitious investments in green technologies in emerging markets by 2030 to avoid creating stranded assets and significant economic losses.

From a financing perspective, emerging markets also represent a significant opportunity for sustainability-linked bonds (SLBs). Debt market-based financing by companies in emerging markets is increasing. Even though SLBs originating from emerging markets reached only 33% of the global volume and 48% of total SLBs in 2023, this was the highest level since 2019. These positive trends indicate a growing recognition of the role that emerging markets play in the global transition to sustainable industry practices,” he further clarified.

Governments as market drivers

One of the points in the report is that governments are key drivers of investment. But how do they achieve this? “There are several ways governments can drive investment. One of the most effective, yet often underestimated, methods is their role as consumers. Public authorities, at all levels, are significant buyers of steel and cement—about 25% of steel and 40% of cement globally. Governments can leverage this purchasing power to influence the market by prioritizing green alternatives in their procurement processes for infrastructure, buildings, roads, and bridges,” Mr. Passaro elaborated.

Additionally, governments can guide investment through the development of clear definitions, roadmaps, and pathways. They can endorse criteria developed by organizations like Climate Bonds Initiative and engage stakeholders to highlight challenges and opportunities. International collaboration and agreement on transition plans are crucial, and bodies like the G20 can facilitate this.

“By setting targets and providing clear guidance, governments can give companies and investors the confidence needed to make substantial capital investments. They can set realistic, phased goals—such as increasing the share of green steel and cement over time—allowing the industry to adapt and invest in necessary technologies,” he highlighted.

It is interesting to note that, except for two, all companies analyzed in the report with performance targets and action plans aligned or aligning with the Climate Bonds Initiative´s methodology are based in jurisdictions that have implemented or are considering implementing transition plan legislation.

Overall, governments can shape the market by acting as both standard-setters and significant consumers, encouraging both public and private sectors to move towards sustainable practices.

Credibility attracts funding

Governmental actions and influence are important, but how can companies ensure they will receive funding? One of the points in the input paper is that financial institutions want to see solid and credible transition plans. But what key elements make a transition plan credible?

“The report emphasizes the importance of credible transition plans for attracting sustainable finance. Here I would like to emphasize that we aim to make our analysis accessible to everyone, from policymakers, financial institutions, to the general public. The nexus between developed criteria, the role of policymakers, and the financial sector is crucial for achieving this transition. This holistic approach encompasses standards, definitions, the role of policy, and the financial market, including new instruments like green bonds and sustainability-linked bonds,” Mr. Passaro stated.

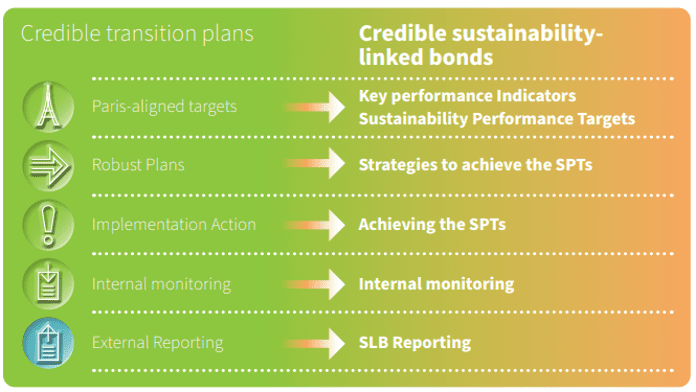

As he shared with us, transition plans are absolutely critical for raising sustainable finance, especially beyond traditional green bonds. Green bonds are specific to projects or activities, but now investors and financial institutions seek comprehensive transition plans covering the entire company. These plans need to set targets for the whole company, not just isolated projects.

“There are three key elements that build up a credible transition plan. The first one is the action plan. This involves detailed plans on what the company intends to do, including specific targets aligned with the Paris Agreement and covering various emission scopes. Standards and criteria per sector, such as those developed by Climate Bonds, help define these targets,” he explained.

“The second component would be financing. A credible plan needs substantial CapEx (capital expenditure) and OpEx (operating expenses) allocations to achieve the set targets. This financial commitment demonstrates the company’s seriousness in reaching its objectives. And finally, the third element is the governance mechanism. Effective governance is crucial. This includes having a dedicated sustainability or transition committee within the company and ensuring oversight through internal and external reviews,” he concluded.

For this report, 20 companies were analyzed, split between steel and cement, to cover a wide geographic and market scope. The three main elements that were assessed are ambition, action, and accountability. These factors together ensure the transition plan is credible and provide confidence to investors.

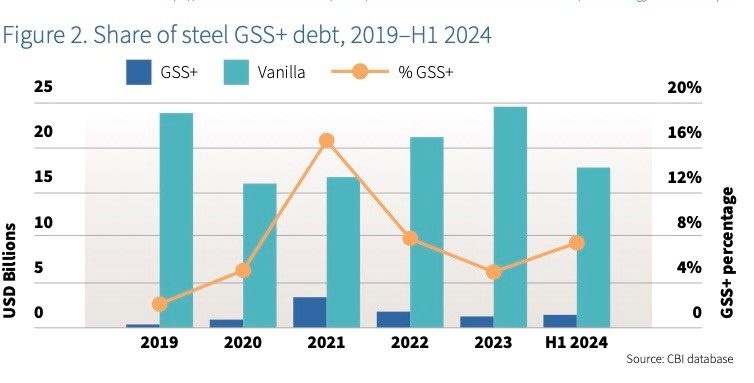

In terms of progress, the share of sustainable debt in steel and cement is growing. Currently, about 7% of steel and around 10-12% of cement debt is sustainable, up from almost zero in 2018 and 2019. Although not yet at 100%, Mr. Passaro believes this growth is encouraging, especially considering the fairly recent start of the transition in these sectors.

Defining a just transition

The concept of a just transition, particularly in the context of steel and cement industries, is still evolving. While the broader discussion around just transition is relatively recent, it is even newer for these hard-to-abate sectors, which have only recently begun to explore this concept in depth.

“In terms of definition, there is no internationally agreed-upon framework for a just transition. However, there are emerging frameworks and guidelines, such as those from the International Labour Organization (ILO) or Organisation for Economic Co-operation and Development (OECD), that companies are starting to reference. Our analysis shows that while the concept of a just transition is still developing, 40% of the steel and cement companies we reviewed acknowledge its importance. This is promising given that the transition discussions in these sectors are still in their infancy,” said Mr. Passaro.

According to the Climate Bonds´ report, a just transition safeguards access to opportunities and prevents inequalities during the shift to net zero. Integrating just transition principles into transition plans ensures their comprehensiveness, preventing disruptions and optimizing the transition pathway. A just transition involves anticipating, assessing, and addressing social risks, while identifying and enabling social opportunities. This process also requires meaningful dialogue and participation in transition planning.

“The ongoing G20 discussions and international forums are critical for advancing these definitions and frameworks. These meetings provide a platform for countries and industries to negotiate and agree upon a standardized approach to a just transition, which will offer clearer guidance for companies worldwide and help ensure that they can effectively move toward more sustainable practices,” he underlined.

The broader picture

“One point I would really like to emphasize, beyond what we have covered, is why the G20 chose to focus on steel and cement in the Sustainable Finance Working Group’s sectoral discussions. This emphasis is not just for those deeply involved in the steel industry but also aims to reach a broader audience. Highlighting the reasons behind this focus can help convey the significance of these industries to a wider range of stakeholders,” explained Mr. Passaro.

“Steel and cement are crucial because they are the two largest industrial emitters by far, each accounting for 6-8% of global emissions. In comparison, other industries like chemicals contribute less than 4%, and aluminum is under 1%. The scale and speed required for the transition in these sectors make it a particularly challenging yet exciting endeavor.

The importance of steel and cement extends beyond their own emissions. They are vital inputs for numerous other sectors. Industries such as automotive, renewable energy infrastructure (including wind farms), bridges, and buildings rely heavily on steel and cement. These sectors cannot achieve their net-zero goals or meet the Paris Agreement targets if the steel and cement they use are not low-carbon, green, and sustainable. Therefore, decarbonizing steel and cement is essential not only for reducing their own emissions but also for enabling other sectors to transition effectively. This interconnectedness underscores the strategic significance of focusing on these industries for a broader and more impactful transition to sustainability,” he concluded.